by Isabela Godoy

In today’s ever-evolving regulatory landscape, businesses face a myriad of challenges when it comes to legal entity management (LEM). From navigating complex tax regulations to ensuring compliance with environmental, social, and governance (ESG) standards, organizations must maintain transparency and accuracy in their corporate structures. Furthermore, industries such as finance, healthcare, and technology rely on rigorous know-your-customer (KYC) and due diligence processes to mitigate risks and drive growth. However, managing data in spreadsheets poses inherent risks, including human error and time-consuming manual processes. In this article, we explore how automated visual charts provided by Newton’s LEM solution offer a reliable and efficient solution to these industry challenges.

1. Establishing Industry Issues:

a) Applicable Regulations:

Tax, Environmental, Social, and Governance (ESG), and Compliance regulations play a pivotal role in shaping organizational structures and transparency matters. The concept of Ultimate Beneficial Ownership (UBO) is central to regulatory compliance, as it requires organizations to disclose the individuals or entities that ultimately own or control the company. Failure to comply with UBO requirements can result in severe penalties and reputational damage.

b) Industries Usages:

Know Your Customer (KYC) and Due Diligence processes are fundamental in various industries, including banking, finance, and real estate. KYC processes involve verifying the identity of customers to prevent money laundering and terrorist financing activities. Due diligence processes, on the other hand, are conducted to assess the risks associated with potential business relationships or transactions. Venture capital and investment companies rely on thorough due diligence to evaluate investment opportunities and mitigate risks effectively.

c) Reliability of Data:

Working with spreadsheets is prone to human error, leading to inaccuracies and inefficiencies in data management. Manual creation of visual charts is time-consuming and can result in failures to accurately represent entity structures. Numerous incidents have highlighted the risks associated with spreadsheet errors, ranging from financial misreporting to product recalls and data loss. These incidents underscore the importance of adopting reliable and automated solutions for legal entity management. Spreadsheets are notorious for their susceptibility to human error, leading to various issues across industries. For instance, a spreadsheet error led to a 3.1 billion dollar loss for JPMorgan’s London Whale [1]. Similarly, during the pandemic, England lost 16.000 test results due to Excel’s row number limitations [2]. Newton’s LEM tool addresses these reliability concerns by automating the creation of visual charts, ensuring accuracy and reliability in legal entity management.

2. Establishing Solutions:

a) Applicable Regulations:

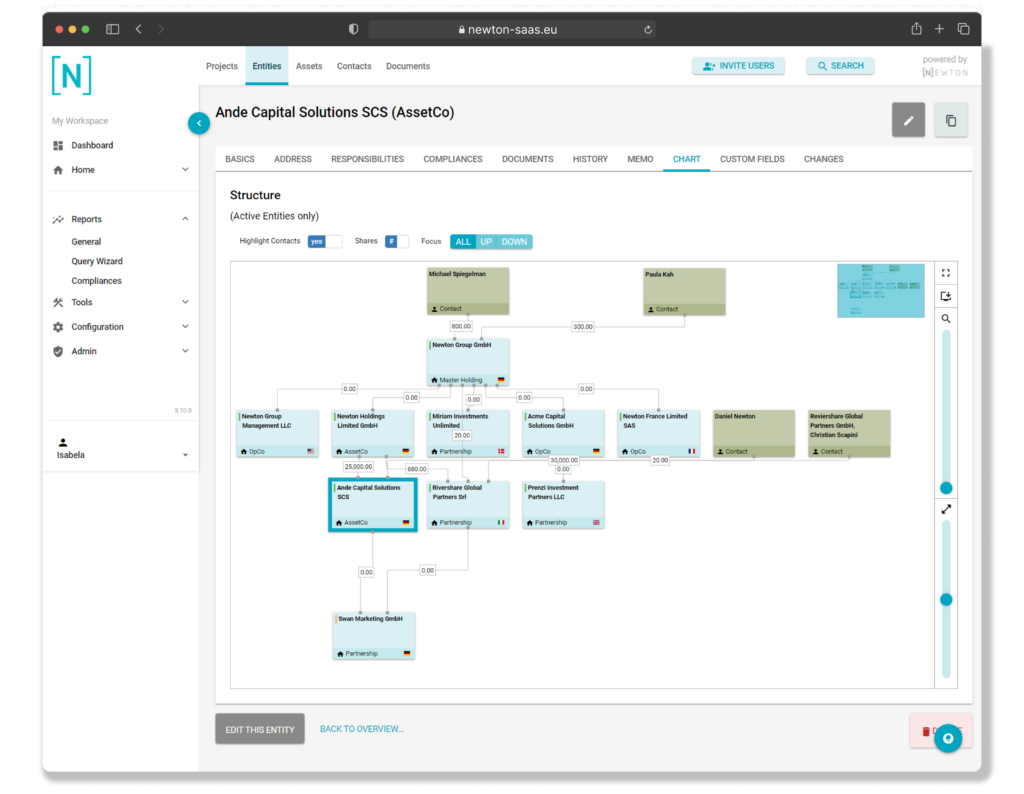

Newton’s LEM platform integrates seamlessly with regulatory compliance requirements, facilitating UBO disclosure and ensuring transparency in entity structures. By automating the generation of visual charts, Newton enables organizations to visualize ownership relationships and comply with regulatory standards effectively.

b) Industries Usages:

Newton’s LEM platform streamlines KYC and Due Diligence processes by providing comprehensive insights into entity relationships and ownership structures. Through automated visual charts, organizations can expedite the verification process, mitigate risks, and make informed decisions with confidence.

c) Reliability of Data:

Newton’s automated visual charts eliminate the risks associated with manual spreadsheet management, ensuring data accuracy and reliability. By centralizing entity data and automating chart generation, Newton minimizes the likelihood of errors and enhances the integrity of governance management processes.

| Area of Issue | Description | How Newton Solves It |

| Applicable Regulations | Tax, ESG, and Compliance regulations affect organizational structure and transparency. | Newton’s LEM tool provides automated visual charts that ensure compliance with regulations by accurately representing data. |

| Industries Usages | KYC and Due diligence processes are crucial for compliance and business transactions. | Newton automates the creation of visual charts, streamlining KYC and due diligence processes, and enhancing efficiency and accuracy. |

| Reliability of Data | Spreadsheets are prone to human error and manual visual chart creation is time-consuming. | Newton’s LEM tool eliminates manual processes and potential errors by automatically generating accurate and up-to-date visual charts. |

Conclusion

In conclusion, the integration of Legal Entity Management with automated visual charts offers a transformative solution for organizations grappling with transparency, compliance, and data reliability issues. Newton’s innovative platform empowers organizations to navigate regulatory complexities, streamline compliance processes, and make informed decisions with confidence. By leveraging the power of automation, organizations can maximize transparency, mitigate risks, and achieve operational excellence in today’s dynamic business environment.

[1] How a Simple Spreadsheet Mistake Caused a $3.1 Billion Loss [2] Covid: how Excel may have caused loss of 16,000 test results in England

Where does NEWTON fit into all of this?

NEWTON delivers an easy and intuitive platform to manage and automate your legal entities’ information, governance, and compliance. With governance being the foundation to all ESG matters, be sure to get in touch to explore how Newton can help you have everything you need to be in control of your entity portfolio.

Get the Latest NEWTON News

Don’t miss out on the latest NEWTON features, updates, and improvements. Subscribe to our newsletter and stay informed about everything NEWTON—new tools, enhanced functionality, and fixes that make compliance management easier for your business!